Cash Advance Apps that Work With Chime: Best Options (February 2026)

Waiting around for payday when bills are knocking is never fun. Ideally, there’s always something left in your account to tide you over. But that’s not always the case.

Sometimes bills hit all at once, the car needs repairs, the electric bill spikes, or something unexpected comes up, and just like that, you're short on cash before payday.

That’s when people turn to cash advances.

These are small, short-term advances on your earned income. Unlike payday loans, which often come with high interest and fees, cash advance apps that work with Chime usually offer interest-free options. Some even skip fees entirely or only charge for faster transfers.

These apps offer a quick fix, not a long-term solution. But they can be helpful for covering a tight spot without committing to a traditional loan. This article introduces you to apps like that.

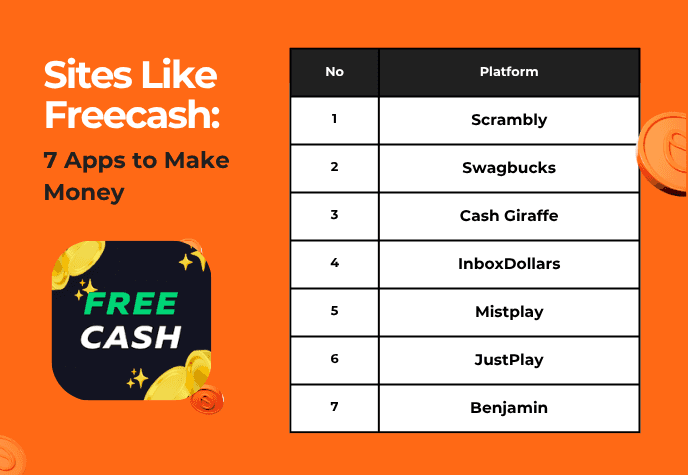

Oh, and if you’re looking for ways to earn a little extra cash without touching your paycheck in the first place, stick around, we’ll also introduce you to Scrambly, a legit way to earn quick rewards by playing games and trying new apps.

Check out ScramblyNow let’s walk through the top cash advance apps that work with Chime and see how they stack up.

7 Top Cash Advance Apps That Work With Chime

The following are the seven top cash advance apps that work seamlessly with Chime and let you get paid easily before your payday.

1. Chime MyPay

Chime’s MyPay is a short-term advance on money you’re already going to earn.

If you’re eligible for MyPay, you can access up to $500 of your paycheck before payday. The MyPay feature requires no credit checks, interest, or required fees, which is a solid setup for anyone trying to avoid the usual debt traps.

The only optional cost is a $2 fee if you want Chime instant loans instead of waiting up to 24 hours. Otherwise, it lands in your account within 24 hours for free.

Eligibility is mostly tied to your direct deposit history. You’ll typically need to have received at least one or two qualifying direct deposits of $200 or more in the past 36 days.

There are a few more specifics, especially if you’re using government benefits, but once you meet the criteria, you’ll see a MyPay hub in your Chime app where you can check how much you’re allowed to borrow.

The app will show you both your available credit and your overall limit, which can range from $20 to $500 depending on your income estimates.

Steps to Access Chime MyPay:

- Set up direct deposit with Chime.

- Qualify through either:

- Two $200+ deposits in the last 36 days, or

- One $200+ deposit plus employer data, or

- One $200+ deposit from a government source.

- Check the MyPay hub in your Chime app to see your available amount.

- Choose how much you want to access (up to your limit).

- Pick the speed: 24 hours (free) or instant ($2).

Chime will automatically collect repayment from your next direct deposit.

One thing to keep in mind: repayment is broken down into two transactions if you use instant advance. One for the $2 fees (all lumped together) and one for the amount you actually borrowed.

2. Cleo

Now, if you’re looking outside Chime’s ecosystem, Cleo is another cash advance app that works with Chime.

Cleo offers $20 to $250 as a cash advance from the paycheck that hasn’t landed yet. It's based on your financial behavior, not your credit score, which keeps the bar for entry lower than a traditional lender.

To get started, you’ll need to set up your paycheck schedule and let Cleo peek into your spending habits by syncing your bills and accounts. It then uses that info to suggest a daily spending limit and tracks your budget. This is Cleo’s way of figuring out if you can handle a cash advance.

If you qualify, you choose how much to borrow, pick a repayment date, and confirm autopay. The smallest amount you can get is $20, and if you need the funds quickly, there’s an express option that’ll cost you anywhere from $3.99 to $9.99. Otherwise, you’ll wait three to four business days, which is free.

But here's the catch: the cash advance feature isn’t available on the free plan. You’ll need to subscribe to Cleo Plus or Cleo Builder, which ranges from $5.99 to $14.99 a month.

Cleo will also attempt to withdraw repayment automatically on the date you selected. If your balance is low, it might only take a partial payment, and try again later.

Steps to Use Cleo for a Cash Advance:

- Set your income by selecting your latest paycheck.

- Add your bills so Cleo can calculate your outgoings.

- Create or confirm a spend limit.

- Request a cash advance and choose your repayment date.

- Enable autopay for Cleo to collect repayment automatically.

- If you choose express transfer, the fee is collected upfront with the repayment.

3. MoneyLion

MoneyLion’s InstaCash feature makes it one of the top cash advance apps that work with Chime.

It functions as a short-term cash advance service, not a loan, and it doesn’t involve credit checks or interest. The amount available can range from $10 to $500, depending on factors like your income patterns and banking activity.

Express delivery is optional and comes with a fee ranging between $0.49 and $8.99. If you opt for standard delivery, the funds can take up to five business days to arrive.

Repayment is typically scheduled for your next expected payday, as determined by MoneyLion based on your direct deposit history.

Steps to Use MoneyLion InstaCash:

- Download the MoneyLion mobile app.

- Create an account and verify your identity (photo ID may be required).

- Link your checking account (must be in your name, 60+ days old, with regular income deposits).

- Set up or link a RoarMoney account or another external checking account.

- Once approved, select the amount you’d like to advance.

- Choose standard or express delivery based on your needs.

4. Albert

Albert also falls under the category of cash advance apps that work with Chime, though it comes with some conditions.

Through its Instant Advance feature, eligible users can access up to $250 without interest or a credit check. However, a Genius subscription priced at $14.99 per month is required to use this functionality.

The standard delivery of the advance is free. If you want the funds instantly and you're transferring them to an external bank account, there’s a flat $4.99 fee.

Initial advance limits are usually lower (around $25 to $50) and may increase over time based on your account history and usage. The average cash advance among Albert users is about $95.

Repayment is automatic and typically deducted from your next direct deposit, whether the funds go to your Albert Cash account or a linked external account.

Steps to Access an Albert Cash Advance:

- Download the Albert app or sign up via Albert.com.

- Open an Albert Cash account and subscribe to Genius.

- Apply for an Instant Advance to check your eligibility.

- If approved, choose an advance amount up to your limit.

- Select where you want the funds to go—Albert Cash or a linked external account.

- For instant delivery to an external account, a $4.99 fee applies.

5. Klover

Klover offers interest-free advances of up to $200, though some users may access more by participating in the app’s points system.

Instead of using credit checks, Klover evaluates account activity and allows users to earn points through optional in-app tasks like watching ads, completing surveys, and scanning receipts. These points can be used to either increase your advance limit (up to $300) or to cover fast-funding fees.

Standard funding typically takes up to three business days. If you prefer faster access, you can pay a fee ranging from $1.49 to $19.99 to get the funds in a few hours. Repayment is automatically pulled from your linked bank account, usually on your next payday.

Klover also offers a paid membership, Klover+, which costs $4.99 per month and includes features like credit monitoring and bill tracking. However, this subscription isn’t necessary to receive a cash advance.

Here are the steps to set up and use Klover:

- Download the Klover app and create an account.

- Link your checking account (Chime is supported).

- Check your eligibility for an advance amount.

- Complete optional in-app tasks to earn points if you wish to increase your limit or cover fees.

- Request your desired advance.

- Choose free standard delivery (up to 3 business days) or pay a fast-funding fee for quicker access.

6. Brigit

Brigit is one of the smoothest loan apps that work with Chime and provides access to up to $250, though many users may qualify for a lower amount, typically between $50 and $100. The app does not perform credit checks and instead evaluates your bank account history and deposit activity to determine eligibility.

The funds are deposited within one to three days, but you can opt for express delivery (within about 20 minutes) by paying a fee between $0.99 and $3.99. Standard funding is free.

Repayment is automatically withdrawn based on your pay schedule, which Brigit identifies using your transaction history.

Brigit charges a monthly subscription fee for access to Instant Cash, either $8.99 or $14.99, depending on your selected plan.

Although the app notes that you can bypass the subscription fee by emailing a specific request each time, this option requires consistent manual effort.

Here are the steps to use Brigit Instant Cash:

- Install the Brigit app and create your account.

- Link your primary checking account (must show regular income and daily usage).

- Brigit reviews your transaction history and determines your eligibility.

- Once approved, request the advance amount within your available limit.

- Choose between standard delivery (1–3 days) or fast-funding for a small fee.

7. Varo

Varo, an online banking app, allows users to access between $20 and $500, depending on their account history and eligibility.

However, for new users, the limit generally caps at $250.

Like some cash advance apps that work with Chime in this list, Varo applies a mandatory fee for every advance, ranging from $1.60 to $40, depending on the amount borrowed. This fee is not optional, and there are no alternate subscription or express delivery charges.

Once approved, the cash advance is instantly deposited into your Varo bank account, and no additional fees are required for fast funding. Repayment is scheduled automatically, but you get to select the repayment date (anywhere between 15 and 30 days after receiving the advance).

If the balance isn't fully repaid by the 30-day mark, Varo continues to withdraw funds until the total amount has been covered. During this time, new advances may not be available.

Here are the steps to use Varo for a cash advance:

- Download the Varo mobile app and open a Varo bank account.

- Set up direct deposits to your Varo account (must total $800+ in the current or prior month).

- Ensure your Varo account has a balance of $0.00 or more.

- Once eligible, tap the “Advance” tile in the app to begin your request.

- Choose the amount you’d like to borrow (up to your eligible limit).

- Select a repayment date between 15 and 30 days from the funding date.

- The advance will be deposited instantly into your Varo bank account, with the fee applied upfront.

FAQs About Cash Advance Apps that Work With Chime

Are instant cash advance apps safe?

Yes, most instant cash advance apps are safe. They use encryption to protect your data and personal information. These apps are often safer than payday loans because they don’t charge high interest. Some may charge optional fees for faster transfers or extra features, but those fees are generally low.

What cash advance apps work with Chime?

There are several cash advance apps that work with Chime, including Chime’s own MyPay, Cleo, Albert, MoneyLion, Klover, Varo, and Brigit. These apps allow you to access a portion of your paycheck early, with different limits, fees, and eligibility rules depending on the app.

How to get a loan through Chime?

To get a loan through Chime, you’ll need to use the MyPay feature:

- Set up direct deposit to your Chime account.

- Meet eligibility criteria by receiving at least one or two qualifying direct deposits.

- Enroll in MyPay via the Chime app.

- View your available amount, which can range from $20 to $500.

- Select how much you want, then choose either free standard delivery or a $2 instant advance.

- Repayment happens automatically on your next payday when Chime receives your deposit.

Read this blog if you want to learn how to send money from Cash App to Chime.

Scrambly: Tension-Free Alternative to Cash Advance

We’ve now looked at several cash advance apps that work with Chime. But what if you could avoid borrowing entirely?

Yes, this is possible through Scrambly!

Instead of borrowing from future earnings, Scrambly gives you the chance to earn real cash or gift cards simply by playing mobile games and using apps.

With over 150 games available, including popular titles like Solitaire Cash and Bingo Blitz, you can start earning in just a few minutes.

Payouts are sent directly to PayPal, which you can then transfer to your Chime account without hassle.

There’s no need to rack up $20 or $50 to cash out. Scrambly lets you cash out with as little as $1, and payments are typically fast. Plus, there are no subscription fees or surprise charges to worry about.

So, if you're asking yourself, “What cash advance apps work with Chime?”, it’s worth considering that maybe you don’t need a loan at all.

Platforms like Scrambly can help you generate the extra cash you need without the stress of repayment schedules.