Best Cash Advance Apps That Actually Work (February 2026)

Let me paint a picture that’s going to feel quite familiar.

Payday is days away, but the bills won’t wait. Maybe your car suddenly broke down, or your rent’s due now. For whatever reason, you need fast cash and don’t want to deal with credit checks, high interest rates, or payday loan traps.

So what’s the solution? Cash advance apps. They give you a quick way to borrow a little money based on what you’ve already earned.

In this guide, I’ll break down the best cash advance apps in 2025 that are actually worth your time (and trust).

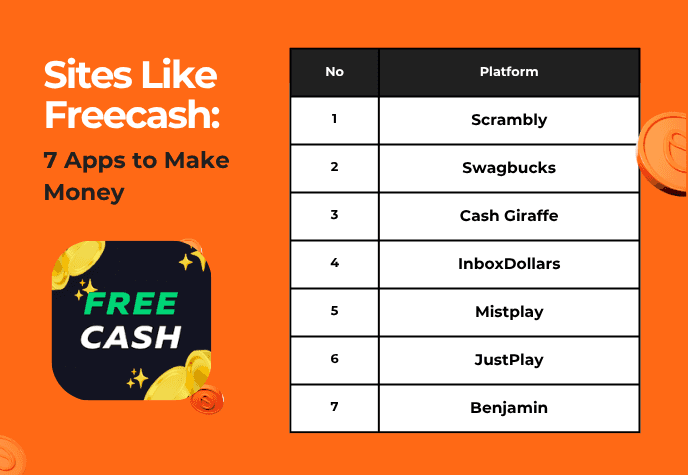

Bonus: At the end of this blog, I am going to tell you about a get-paid-to platform called Scrambly that allows you to earn PayPal cash or gift cards just by playing mobile games or using apps.

Checkout Scrambly

What Is a Cash Advance App?

A cash advance app is a mobile app that gives you early access to money you’ve already earned, usually before your next paycheck arrives.

These apps are sometimes also called paycheck advance apps, earned wage access apps, or simply payday advance apps (though they’re not the same as payday loans).

People use cash advance apps for numerous reasons, like covering surprise bills, avoiding overdraft fees, or just getting through a tight week.

The main draw is convenience. You don’t need good credit. You don’t have to fill out long forms. And you’re not dealing with high-interest payday loans.

Most apps don’t charge interest either. Instead, they may ask for a small subscription fee or an optional tip.

Some even offer instant transfers for a small express fee, while others stick to free standard deposits within 1–3 business days.

9 Best Cash Advance Apps That You Can Trust

When it’s about money, you can’t just trust any app that claims to be the best. (They all do!)

But after a lot of research, I’ve narrowed down a list of the nine best cash advance apps for you below.

You can always count on them on your rainy days when those money-saving tips fail to deliver!

1. Earnin

Earnin is the best cash advance app for a reason. It lets you access money you’ve already earned, i.e., up to $150 per day and $750 per pay period without waiting for payday.

You link your bank via Plaid and verify earnings either by clocking in/out at work or using your own timesheets.

Standard transfers take 1–3 business days, but if you're in a real pinch, their Lightning Speed option can fund you in about 30 minutes for a $2.99–$5.99 fee.

When payday arrives, the app automatically deducts what you took. There’s no interest or required fees, just an optional tip.

App Ratings:

- TrustPilot: 4.5 stars

- App Store: 4.7 stars

- Play Store: 4.7 stars

2. Dave

Dave offers advances up to $500 (called ExtraCash), but you’ll need to open a Dave checking account and pay a $5 monthly membership fee. You must link another bank and have qualifying direct deposits (usually $1,000+ per month).

The advance shows up instantly in your Dave checking account. Also, external withdrawals take 2–3 days, or you can pay a 1.5% fee for same-day external transfer. Repayment is automatic with your next paycheck or by the next Friday.

No interest, but there’s a $5 overdraft-like fee (or 5% of the amount) and express transfer/subscription costs.

App Ratings:

- App Store: 4.8 stars

- Play Store: 4.4 stars

3. Brigit

Brigit offers a simple, fee-free advance up to $250. For a monthly subscription of $8.99–$14.99, you can tap into your own money early based on your checking account’s balance and income flow.

Setup only requires linking your bank and enabling small overdraft protection. Once you request cash, it’s usually deposited via ACH (fast during business hours). The app automatically deducts the advance from your next paycheck.

App Ratings:

- TrustPilot: 4.5 stars

- App Store: 4.8 stars

- Play Store: 4.7 stars

4. Current

Current combines mobile banking with paycheck-advance features. With regular direct deposits, you can access up to $750 through Spot Me and small earned-wage advances.

Linking your checking account is all that’s needed, and the app delivers free advances in three business days. You can also get it instantly by paying a small express fee.

Repayment happens automatically when your bank deposits arrive. Compared to payday loans, it is relatively faster and friendlier.

It’s a solid pick for anyone wanting budgeting tools and cash access in one.

If you’re looking for an app built for students and young adults with great perks, Firstcard is also worth exploring.

App Ratings:

- App Store: 4.8 stars

- Play Store: 4.7 stars

5. Empower

Empower offers advances ranging from $10 to $400, depending on your income history. The app charges a monthly subscription of $8, but occasional promo credits may reduce this.

You link your primary checking account, and if the balance is sufficient, the app delivers funds often within minutes or one business day via standard transfer. Repayment is pulled automatically at the next deposit.

If you look up best cash advance apps Reddit, you’ll see a few users note customer service quirks or repayment timing, but others praise its overdraft protection (Empower even reimburses some bank fees).

App Ratings:

- App Store: 4.8 stars

- Play Store: 4.7 Stars

6. DailyPay

DailyPay connects directly with your employer to let you access your earned wages on demand. So, it might not work for your weekend side hustles.

Once the company signs up, you can take out as much as you’ve earned between pay periods.

Transfers are usually instant or same-day, based on employer setup, with fees often covered by the employer. You choose how much to withdraw, and repayment happens automatically when payday rolls around.

I find it quite convenient for budget control. However, note that frequent withdrawals may incur costs. Still, it’s one of the best apps for cash advance due to its transparency and effectiveness.

App Ratings:

- TrustPilot: 3.3 stars (some of the recent reviews are 1-star)

- App Store: 4.8 stars

- Play Store: 4.7 stars

7. Clover

For small business owners, Clover offers merchant cash advances tied to future credit or debit sales. It integrates with your Clover POS system, so approval takes 1–2 days and funding arrives in 2–3 business days.

Repayment is automatic. Clover deducts a fixed percentage of daily card sales until the balance is paid off. There’s no interest, but total repayment is higher than the amount received, so it’s kind of like a fee.

What people appreciate about it is that it avoids credit checks and loan paperwork, so it’s surely among the top cash advance apps for urgent business needs only.

App Ratings:

- App Store: 4.9 stars

- Play Store: 4.6 stars

8. MoneyLion (Instacash)

If you have a MoneyLion account, you can access up to $250. Funds arrive in 1–5 business days, and you also get access to several financial management tools.

There’s no interest, and tips are optional, but the app does nudge you to add one. While most people appreciate its convenience, some report account closures and delayed deposits.

Still, it’s a good alternative to predatory payday loans.

App Ratings:

- TrustPilot: 3.9 stars

- App Store: 4.8 stars

- Play Store: 4.7 stars

9. Chime

Chime isn’t a traditional money app cash advance, but it allows eligible users to overdraft up to $200 (or more over time) without a fee. You need monthly direct deposits to qualify.

The protection covers debit card purchases and ATM withdrawals instantly without any fees or interest. When your next deposit comes in, Chime automatically covers the overdraft. You can even send money from Cash App to Chime easily.

Users love the zero-fee experience, but a few warn that advertised limits sometimes don’t match reality. It’s nevertheless one of the best instant cash advance apps.

App Ratings:

- TrustPilot: 3.4 stars

- App Store: 4.8 stars

- Play Store: 4.7 stars

These are not random names on a random list. I’ve personally tested out all of them before labeling them as the best cash advance apps.

Use Scrambly & Earn Without Investment

We all have those days when we need quick cash without borrowing or paying interest. But tell you what, instead of always turning to these best cash advance apps, why not earn some extra money on the side?

Scrambly is a legit and beginner-friendly money-earning app that lets you earn real rewards by completing simple tasks like trying new apps or playing mobile games.

There’s no upfront payment, no catch, and no investment required. The only investment you’re required to make is your time. You can use it as a stress-free way to make extra income between paychecks.

Give Scrambly a shot by downloading it today. You’ll love how fast and easy it is!

Download Scrambly NowFAQs About Best Apps For Cash Advance

What is the best instant cash advance app?

Apps like Earnin and Dave are among the best instant cash advance apps for 2025. They offer fast access to wages without high fees or credit checks.

Are cash advance apps legit?

Yes, most cash advance apps are legit, especially well-known ones like Brigit, Chime, and Empower. Always read reviews and terms before signing up.

How much money can you borrow from cash advance apps?

You can usually borrow $20 to $500. It depends mostly on your income, app usage, and repayment history. Some apps may increase your limit over time.

Download Scrambly